گزشتہ ہفتے، تیل کی قیمتوں میں کمی کے بعد، خاص طور پر برینٹ زیادہ صحت مندی لوٹنے لگی، انگوٹی کی اوسط قدر بنیادی طور پر فلیٹ تھی، صرف ماہ کے لیے امریکی خام تیل کی قیمت میں کمی کی وجہ سے. ایک طرف، اجناس میں عام کمی کے تحت پری میکرو دباؤ، خام تیل کو بخشا نہیں گیا تھا، مارکیٹ کے جذبات اعتدال پسند مرمت کے بعد، تقریبا تمام اشیاء صحت مندی لوٹنے حاصل کر لیا ہے؛ دوسری طرف، خام تیل کے بنیادی اصولوں میں کوئی تبدیلی نہیں آئی ہے، اور دیگر بنیادی طور پر کمزور اقسام کے مقابلے میں اسٹاک کم رہتا ہے، خام تیل ایک غلط قسم ہے، لہذا، نسبتا مزاحمت میں کمی، نیچے کی حمایت مضبوط ہے، اور ریباؤنڈ کی رفتار۔

جمعہ (1 جولائی) کو نیویارک کموڈٹی فیوچر ایکسچینج ویسٹ ٹیکساس لائٹ کروڈ آئل فیوچر برائے اگست 2022 $108.43 فی بیرل پر طے ہوا، پچھلے تجارتی دن سے $2.67، یا 2.5% زیادہ، ٹریڈنگ رینج $104.56-109.34 کے ساتھ؛ لندن انٹرکانٹینینٹل ایکسچینج میں ستمبر 2022 کے لیے برینٹ کروڈ آئل فیوچر $111.63 فی بیرل پر طے ہوا، جو پچھلے تجارتی دن سے $2.60، یا 2.4%، $108.03-$112.45 کی ٹریڈنگ رینج کے ساتھ، $2.60 سے زیادہ ہے۔ تصویر

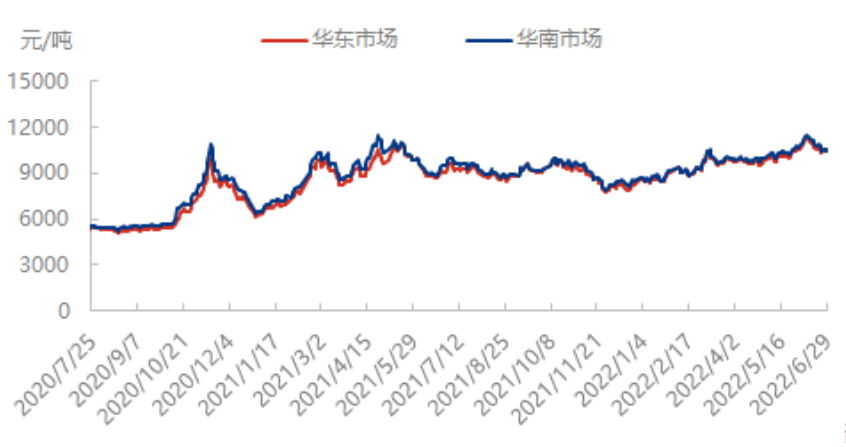

جیسا کہ بین الاقوامی تیل کی قیمتوں میں قدرے اضافہ ہوا، میکرو جذبات بھی عارضی طور پر مستحکم ہیں، اسٹائرین پلیٹ گرنا بند ہوگئی اور قدرے بڑھ گئی۔ ایک ہی وقت میں، مہینے کے اختتام کے قریب، اسپاٹ مارکیٹ زیادہ گھبراہٹ کا شکار ہے، اسپاٹ کی قیمت کو بڑھانے کے لئے مختصر مطالبہ کو بھریں؛ اور پھر جولائی کے اوائل میں اہم بندرگاہ کی انوینٹری کے جواب یا بنیاد اختلافات میں متوقع کمی کے تسلسل کو مضبوط کرنے کے لئے جاری ہے، تو styrene مارکیٹ جھٹکا گزشتہ ہفتے.

مارکیٹ کے لیے آؤٹ لک کا تجزیہ

لاگت: اس ہفتے خام تیل، سعودی عرب کے امریکی دورے کے قریب، اوپیک کی اندرونی میٹنگ، گزشتہ دو سال کی پیداوار میں کمی کا اجلاس ختم ہو جائے گا، اس کے بعد متعدد ممالک میں پیداوار میں اضافے کے لیے جگہ کی موجودگی، جیسے کہ متحدہ عرب امارات اور سعودی عرب اور دیگر خدشات کے باعث پیداوار بڑھے گی۔ اس کے علاوہ، امریکی موسم گرما کی مانگ چوٹی پس منظر، سٹوریج کی گیسولین انوینٹری حیرت انگیز طور پر مسلسل جمع، اور ریفائنری منافع کو سکیڑنا شروع کر دیا، اس بات کا اشارہ ہے کہ ٹرمینل منفی آراء شروع ہو گئی ہے، سستی کی علامات کی بنیادی باتیں۔ اس لیے تیل کی قیمتوں میں کمزوری سے ایڈجسٹ ہونے کا امکان ہے۔

طلب کی طرف: توقع ہے کہ گزشتہ ہفتے کے مقابلے اس ہفتے مجموعی گھریلو ABS پیداوار میں قدرے کمی آئے گی، اور بہاو کی طلب کمزور رہ سکتی ہے۔

اس ہفتے اسٹائرین اسپاٹ مارکیٹ کے مضبوط ہونے کی امید ہے، اور فیوچر مارکیٹ کی کارکردگی میں تبدیلی جاری رہ سکتی ہے۔ سپلائی کی طرف سے، نئے یونٹس کو کام میں لایا جائے گا اور جولائی کے اوائل میں خلیج کو دوبارہ شروع کیا جائے گا، اور مقامی پیداوار میں 8.11 فیصد اضافہ متوقع ہے۔ اس وقت، مین پورٹ کی آمد کا اگلا چکر 20,500 ٹن ہونے کی توقع ہے، اس ہفتے ٹرمینل پر 15,000 ٹن ایکسپورٹ لوڈنگ ہو سکتی ہے، برآمدات، اگرچہ جہاز بھیجنے کا منصوبہ ہے، لیکن تاخیر، انوینٹری یا چھوٹی کمی ہو سکتی ہے۔ ڈیمانڈ کی طرف، اس ہفتے PS اسٹارٹس میں تھوڑا سا اضافہ ہوسکتا ہے، ABS اسٹارٹس میں کمی کی توقع ہے، EPS اسٹارٹس زیادہ تبدیل نہیں ہوتے، مجموعی ڈیمانڈ کی کارکردگی مستحکم ہے۔ خام مال کی طرف، خالص بینزین اور خام تیل یا کمزور تکمیل، لاگت کی حمایت کمزور ہے. اس وقت، مارکیٹ کی صنعت کا نقطہ نظر عارضی طور پر مضبوط ہے، بنیادی طور پر تنگ جگہ کی طرف سے حمایت کی، لیکن یہ بھی خام تیل کی کمزوری کے اثرات کے بارے میں فکر مند، aromatics کی قیمتیں گرنا شروع کر دیا، styrene کی قیمتوں کو متاثر. گھریلو صحت عامہ کے واقعات کے ساتھ جامع صفائی، کام کی بحالی اور ٹریک ڈیمانڈ پر پیداوار میں بہتری کی توقع ہے، بہتر کھپت کی توقع میں قلیل مدتی اسٹائرین کی بحالی، درمیانی مدت مختصر رہتی ہے۔

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

پوسٹ ٹائم: جولائی 06-2022